Breathe Easier With These Home Mortgage Tips

Article by-Alexander BynumAre you a mortgage loan veteran? The mortgage marketing is constantly undergoing changes, for people buying their first homes to the people seeking to refinance. You need to keep up on these changes in order to get the best mortgage for your situation. Read on to learn more about home mortgages.

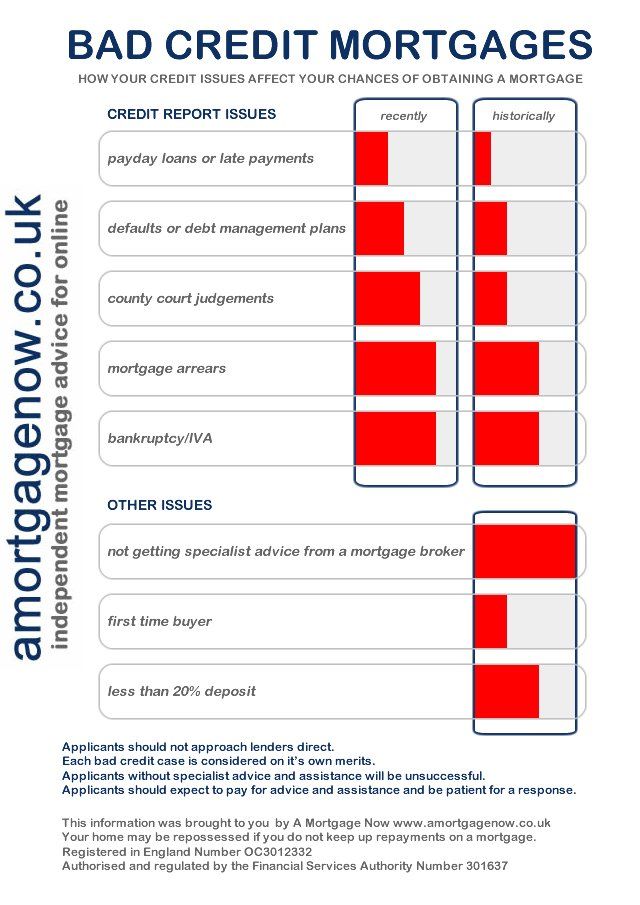

Save enough money to make a down payment. Lenders may accept as little as 3.5% down but try to make a larger down payment. If you put down 20% of your total mortgage, you won't have to pay private mortgage insurance and your payments will be lower. You will also need cash to pay closing costs, application fees and other expenses.

If you can afford a higher monthly payment on the house you want to buy, consider getting a shorter mortgage. Most mortgage loans are based on a 30-year term. A mortgage loan for 15 or 20 years may increase your monthly payment but you will save money in the long run.

Your mortgage application might get denied in the final stages due to sudden changes to your overall financial standing. It's crucial that you are in a secure job position before getting a loan. You should also avoid changing jobs while you are in the loan process since your loan will depend on what is on your application.

If you're buying a home for the first time, there may be government programs available to you. This can help reduce your costs and find you good rates. It may even find you a lender.

Before looking to buy a house, make sure you get pre-approved for a mortgage. Getting pre-approved lets you know how much you can spend on a property before you start bidding. It also prevents you from falling in love with a property you can't afford. Also, many times seller will consider buyers with pre-approval letters more seriously than those without it.

Adjustable rate mortgages, or ARM, don't expire when the term is over. Rather, the applicable rate is to be adjusted periodically. This creates the risk of an unreasonably high interest rate.

Consider a mortgage broker instead of a bank, especially if you have less than perfect credit. Unlike banks, mortgage brokers have a variety of sources in which to get your loan approved. Additionally, many times mortgage brokers can get you a better interest rate than you can receive from a traditional bank.

An adjustable rate mortgage won't expire when its term ends. However, the rate is going to be adjusted to match the rate that they're working with at the time. This could increase the rate of interest that you pay.

Know the risk involved with mortgage brokers. Many mortgage brokers are up-front with their fees and costs. Some other brokers are not so transparent. They will add costs onto your loan to compensate themselves for their involvement. This can quickly add up to an expense you did not see coming.

Many computers have built in programs that will calculate payments and interest for a loan. Use https://www.nytimes.com/2021/10/05/business/banks-occ-omarova.html to determine how much total interest your mortgage rate will cost, and also compare the cost for loans with different terms. You may choose a shorter term loan when you realize how much interest you could save.

You likely know you should compare at least three lenders in shopping around. Don't hide this fact from each lender when doing your shopping around. They know you're shopping around. Be https://bankingjournal.aba.com/2021/09/federal-government-issues-guidance-for-federal-contractors-vaccine-mandate/ in other offers to sweeten the deals any individual lenders give you. Play them against each other to see who really wants your business.

Remember that there are always closing costs and a down payment associated with a home mortgage. Closing costs could be about three or four percent of the price of the home you select. Be sure to establish a savings account and fund it well so that you will be able to cover your down payment and closing costs comfortably.

If you have a lot of open credit cards, consider paying them off and closing the accounts before applying for a home loan. Many lenders look negatively upon the overuse of credit. So, by closing your credit card accounts, you can show that you are a worthy credit risk for the lender.

Be careful about quicksand mortgages. These are mortgages that have all sorts of hidden tricks in them like balloon payments, prepayment penalties, tons of upfront fees, and more. These loans typically are only helpful to the lender, not to the customer. In fact, they can make your loan down right unaffordable over time.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

Set a budget prior to applying for a mortgage. If you end up being approved for more financing than you can afford, you will have some wiggle room. However, it is critical to stay within your means. Doing so could cause severe financial problems in the future.

Compare the loan origination fees. There is more to a loan than just the interest rate that you agree to. Points are applied to the loan as well, and can mean a great deal when it comes to what your total cost will be on your home mortgage. Keep this in mind from the start.

Now that you're done reading these motivational tips, you are off to a good start. Do not feel overwhelmed by this process and learn as much as you can about buying a home. Using these tips will help you get a better mortgage in the end.